In September 2013, Bart Watson, the Staff Economist for the American Brewers Association, wrote an article titled “The Craft Beer (Non) Bubble”. What he wrote turned out to be remarkably prescient for the US market today and is likely to indicate where the New Zealand craft beer industry may be heading in the future as we are generally considered to be a few years behind our American friends.

In September 2013, Bart Watson, the Staff Economist for the American Brewers Association, wrote an article titled “The Craft Beer (Non) Bubble”. What he wrote turned out to be remarkably prescient for the US market today and is likely to indicate where the New Zealand craft beer industry may be heading in the future as we are generally considered to be a few years behind our American friends.

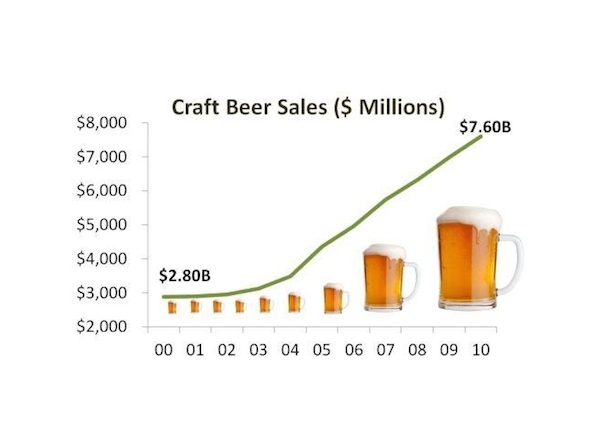

Here are the highlights:

“One of the most frequently asked questions surrounding the craft brewing industry these days is “are we in a bubble, and if so, when will it pop?” I’ll cut straight to the chase and give the short answer: I see little to no evidence that craft is in a bubble. Now for the longer answer…

First, let’s define a bubble. A bubble is a period of overinvestment where asset prices aren’t aligned with reality. In other words, people are betting on a future that won’t exist. Sadly, too many Americans now understand this all too clearly, having invested in a housing market that they assumed could only go up…

This leads me directly to my second point: everyone should stop talking and/or worrying about the number of breweries. For one, the number of breweries includes brewpubs, and while there are only so many seats at existing brewpubs, the brewpub category has plenty of growth potential. How many neighbourhoods in America can support a new high-quality brewpub down the street? (Note the quality part: that’s a minimum to play these days).

The answer is probably a lot, just the same as a new, high-quality restaurant, or a great new bar. In addition, there’s plenty of evidence that America can support a ton of new breweries. Germany has 1,300 breweries, with a heck of a lot less people. If the United States had the same number of breweries per capita (our population is over 3.8x bigger), that would mean 5,000 breweries. Whether the US can support 5,000 or 10,000 breweries, however, is pretty irrelevant without knowing how much beer they are each making.

Craft’s market share is strongest amongst the youngest generations, it is driven by 2,500 innovating brewers attuned to local markets, and together these consumers and producers are helping shift American beer culture. We see this in the fact that markets with the strongest craft presence continue to grow. Oregon, one of the most mature craft markets in the country, still saw production volume grow by 11% in 2012.

Finally, it is worth noting that as craft develops further, a more mature market means that volume growth will inevitably slow and some entrants will fail. But, slowing growth or a rising rate of closings doesn’t mean a bubble has burst. At a certain point, a growing base means that 10 or 15% volume growth becomes more and more difficult, as the same percentage rate requires a greater growth in barrels produced every year. Similarly, a slowing rate of openings or increased closings should not be taken as a sign that the craft market is collapsing. Think again about restaurants, how many close every year – does that mean we are in a restaurant bubble? Although it is likely craft will reach a point (hopefully many years) down the road where volume percentage growth slows and closings equal openings, this is a sign of a mature marketplace rather than a bubble.”

It is worth noting that New Zealand has more breweries per person than Germany, American and Great Britain.

Source: Brewers Association – http://www.brewersassociation.org/insights/the-craft-beer-non-bubble/